INNOVATIVE MODEL PORTFOLIOS WITH RISK CONTROLS

Unlock Optimal Wealth Growth and Preservation

Discover the Power of Our Superior Risk-Adjusted Model Investment Portfolios

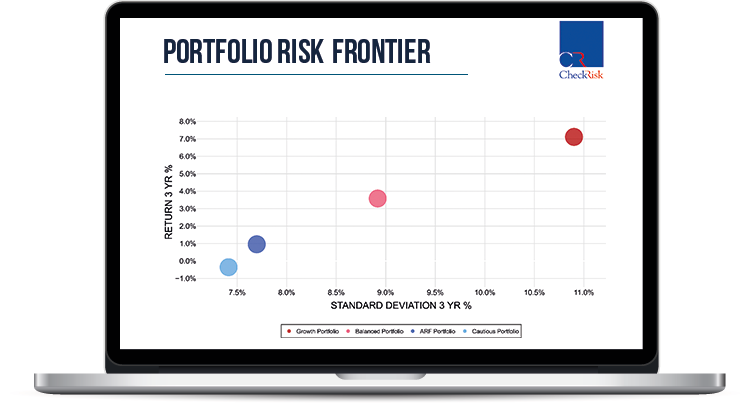

Unique 'investing for risk' approach

Our proven method minimizes drawdowns and maximizes returns, ensuring your clients' portfolios are on the right track to grow over the long term.

tailored for the adviser market

Our range of multi-asset reference model portfolios is designed specifically for the Irish financial services market, catering to both retail and corporate end investors.

Simplified administration & reduced trading costs

Expert support & Monthly Teleconferences

How we do it

1

We start with a portfolio that seeks maximum diversification and stability across multiple asset classes. We select from a global universe that includes countries, sectors, styles, factors, and currencies. We also screen for low charges and high liquidity.

2

Through rigorous research, we have built numerous quantitative models to forecast the oncoming market and economic environment that are robust to forecasting risk and return. Our practitioners sense-check the results.

3

We take the forecasts from the models and practitioners and run thousands of simulations and then optimise for risk and return for the period ahead. Each portfolio is volatility adjusted for its risk profile and is comprised of low-cost building blocks, such as ETFs.

4

We regularly monitor portfolios against their risk objectives and ensure consistency with their mandates over time.

.

.